Don't Pay Collection Companies, We Can Help!

As a consumer you have the right to compel

Facts about your consumer rights with the FDCPA

Don't ever settle

Paying off debt collections will drop your credit score 50-80 points and also a remaining record on your credit score.

Know your rights

You have rights under the federal law FDCPA that can help you. Debt collectors violate the law every day.

Disputing doesn't work

Disputing online through apps or websites make things ever worse.

They can come back

After a dispute, another company can post the item back.

Do Collection Companies Sue?

Collection companies are known for suing consumers. Judgements are filed everyday under consumers.

Consult with us.

Instead of figuring this out on your own. Please get with us today to get a consultation on how we can help. Clean your record and even get you paid.

We Are Trusted Leaders in FDCPA

Jusfi Consulting identifies and addresses violations of the Fair Debt Collection Practices Act (FDCPA), Fair Credit Reporting Act (FCRA), and Telephone Consumer Protection Act (TCPA) on behalf of consumers. By leveraging these violations, we assist in the removal of collection accounts and other inaccuracies from credit reports, thereby expediting the resolution process. When necessary, our affiliated law firms issue demand letters or consult with clients to determine if legal action is warranted to achieve optimal outcomes. In many instances, this process may result in compensation for our clients from the entities responsible for the negative reporting.

Over thousands of cases resolved under our professionals.

100% Satisfaction Guarantee

We take everyone's case seriously with our fully ability to help you get the best results.

How Our Program and Restoration Works

Review Credit Reports

Agreements in place so we can act on your behalf

Certified mail sent to debt collectors

Violations submitted

Network of Attorney to file demand

Settlement

PREMIUM SERVICES

Discover Our Credit Repair and Restoration Works

Pay nothing up front

$250 filing & mailing fee

FAQ

What is FDCPA

The Fair Debt Collection Practices Act (FDCPA) is a federal law that protects consumers from abusive, unfair, or deceptive practices by third-party debt collectors. It provides guidelines for how debt collectors must operate and grants consumers certain rights.

How can your agency help with third-party debt collection?

Our agency assists consumers by ensuring that third-party debt collectors comply with the FDCPA. We review collection practices, communicate with collectors on your behalf, and take legal action if any violations of your rights are identified.

What should I do if I believe a debt collector has violated my rights?

If you suspect a debt collector has violated your rights under the FDCPA, contact us immediately. We will assess the situation, advise you on the best course of action, and, if necessary, file a lawsuit to protect your rights and seek compensation.

What types of FDCPA violations can lead to a lawsuit?

FDCPA violations that may lead to a lawsuit include harassment, using deceptive practices, threatening legal action without intent, contacting you outside of permissible hours, or discussing your debt with unauthorized third parties. If you've experienced any of these, we can help.

How does the lawsuit process work?

After reviewing your case and identifying any FDCPA violations, we will file a lawsuit on your behalf. Our legal team will represent you throughout the process, working to secure compensation for damages such as emotional distress, lost wages, or statutory penalties.

What is arbitration, and how can it help with debt collection disputes?

Arbitration is an alternative to going to court. It’s a process where a neutral third-party arbitrator hears both sides of a dispute and makes a binding decision. We can help you navigate arbitration to resolve disputes with debt collectors more efficiently.

Can you help me repair my credit after resolving debt collection issues?

Yes, we offer comprehensive credit repair services. After addressing your debt collection issues, we will work with you to remove inaccurate or outdated information from your credit report, helping you improve your credit score.

How long does it take to resolve an FDCPA violation case?

The timeline varies depending on the complexity of the case. Some cases may be resolved within a few months, while others may take longer. We will keep you informed throughout the process and work to achieve the best possible outcome as quickly as possible.

What are my rights under the FDCPA?

Under the FDCPA, you have the right to be free from harassment, receive clear information about your debt, dispute your debt, and request that a debt collector stop contacting you. You also have the right to sue for damages if these rights are violated.

How do I get started with Jusfi Consulting services?

Getting started is easy. Simply purchase the plan that suits you best, fill out our secured intake form, and we will schedule an initial consultation. During this consultation, we'll discuss your situation and outline the steps we can take to protect your rights and improve your financial standing.

Meet Out Team Member

Violet Brantley

CEO / Credit Expert

Steven Ha

Co-CEO / Business

Cali Miaw

CMO

Our Client Reviews

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. Cum sociis natoque penatibus et magnis dis parturient montes nascetur.

John Beli

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. Cum sociis natoque penatibus et magnis dis parturient montes nascetur.

Holing Tums

Developer

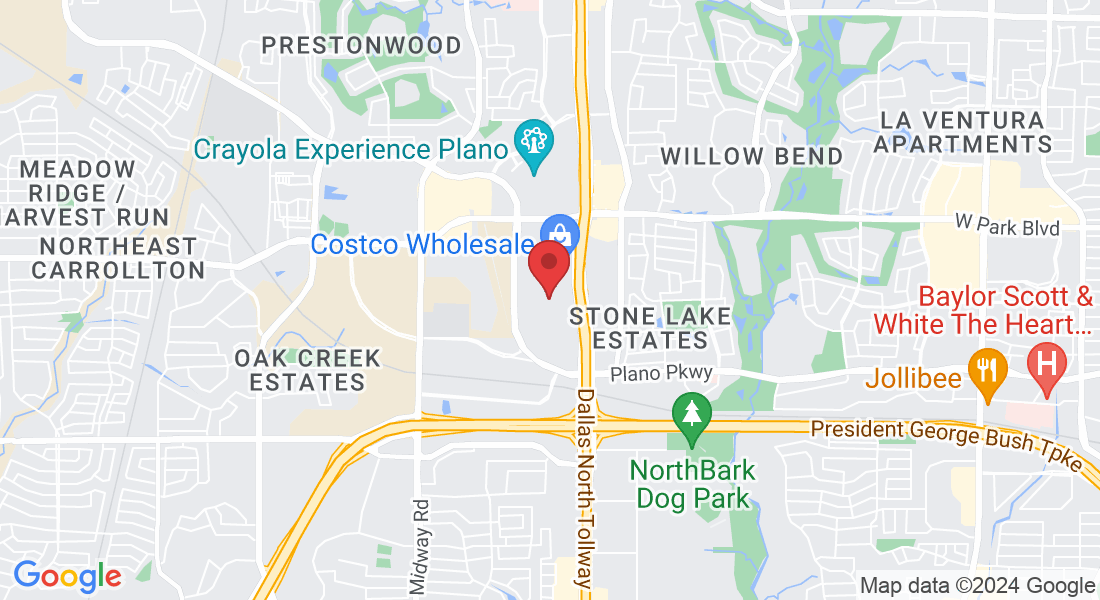

Office: 6275 W Plano Pkwy Suite 500, Plano, TX 75093

Call xxx-xxx-xxxx

Email: [email protected]

Site: www.jusficonsulting.com

Jusfi is not an attorney or a law firm. Nor is it a substitute for an attorney, lawyer or law firm. We do not provide legal advice nor do we practice law. This site only contains legal information, not legal advice. Jusfi is a self-help tool and experts help. This site does not create an attorney-client relationship. We provide no guarantee regarding case outcomes nor are we liable for any case outcomes. Use of its products are governed by its Terms of Service, Privacy Policy, and Legal Disclaimer.